What is the difference between Whole Life Insurance and Term Life Insurance?

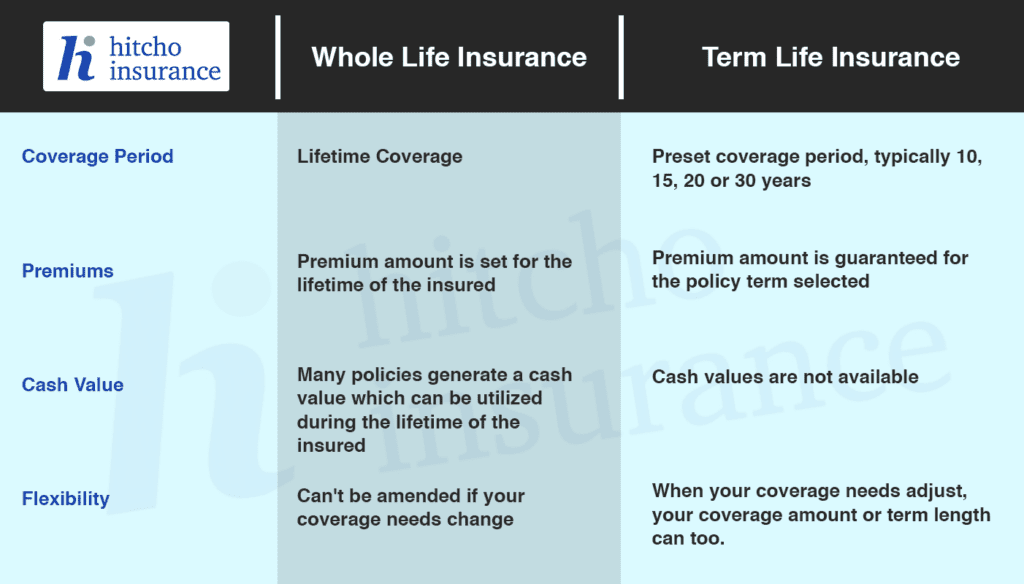

Any form of life insurance provides beneficiaries with an ongoing source of income in the event of the breadwinners passing. Highlighted below are the differences between Whole Life Policies and Term Life Policies.

What is Term Life Insurance?

Term life insurance is the most affordable way to protect your family’s financial security if something happens to you. It replaces your income and helps ensure that the ones who depend on you can support themselves in your absence.

Term Life insurance provides coverage for a specific period of time. Because you only pay for the coverage for as long as you need it, term insurance is considered more affordable than whole life insurance.

Who can buy term life insurance?

Most people between the ages of 18 and 80 can purchase term life insurance. It’s possible for cancer survivors, diabetics and individuals who take medications for cholesterol, blood pressure and other conditions to obtain coverage.

How does term life insurance work?

You can purchase term life insurance for 10, 15, 20 or 30 years. As long as you pay your premiums on time, your policy will remain active. If something happens to you while the policy is active, your beneficiary will receive a death benefit for the amount of the policy.

Why are so many online quotes inaccurate?

Many instant online quotes are not accurate because they’re based on very little personal information. Your health history and a number of personal factors are utilized to produce more accurate quotes. This is why it is important to speak to a licensed professional. Different companies have different prices and also can specialize in favorable rates for different risks.