How does Medicare and VA Coverage Work Together?

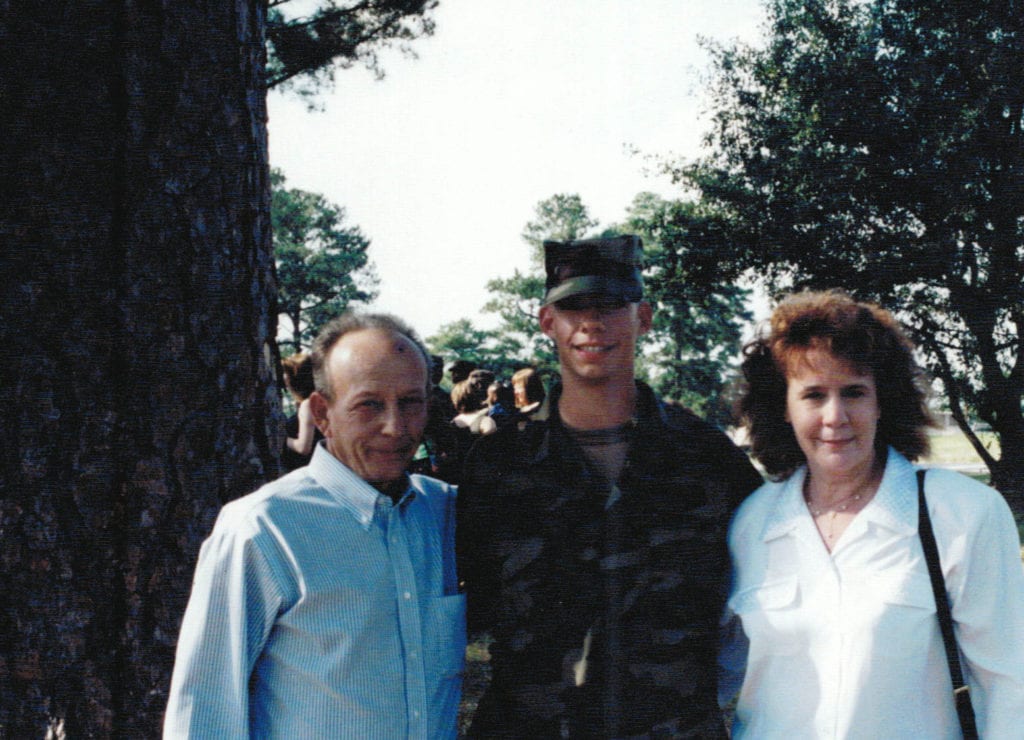

Anyone who served in the military is a hero and should be given the proper coverage they deserve. While the VA provides many benefits to those in the armed forces, there are areas where it is weaker or doesn’t provide all the necessary coverage. This is where having Medicare benefits can help with filling in the coverage gaps.

One of the biggest reasons to have both Medicare and VA benefits is that it provides a safety net should anything happen to the U.S. Department of Veterans Affairs. The VA normally assigns each enrollee a different priority level based on factors, such as income and medical conditions, from serving in the military. If there were ever an instance when the VA lost funding, some of the veterans in the lower priority groups could lose benefits. Having Medicare as a backup plan in this scenario would allow these individuals to continue having healthcare insurance.

Another reason for having both Medicare and the VA benefits is that you will have more comprehensive coverage with both then you would have with either plan on its own. While VA hospitals and doctors are covered under VA benefits, it won’t help with the costs if you ever need to go somewhere else. Even during emergencies. Having Medicare eliminates the need to remain close to a VA facility and allows you to go anywhere if an urgent situation were to arise.

It is also a good idea to enroll in Medicare benefits when you turn 65 to avoid any penalties in the future should you ever need to enroll later in life. If you were ever to lose your VA benefits or decide you want Medicare after the enrollment period, you could be subject to fees and penalties that get added to your premium each year. There is also a chance that you would need to wait an extended period of time before you could receive some of the coverages under Medicare.

Medicare Part D and VA Benefits

Another option you have available to you that isn’t as time-sensitive is obtaining Medicare Part D to help with the costs of prescription drugs. Unlike Original Medicare, enrolling late to Part D will not result in penalties, as long as you sign up within two months of losing VA benefits. There is also greater flexibility when getting prescription drugs as you can decide which option you use to get the lowest price.

How We Can Help

20+ years of experience, providing protection and coverage for clients and their families has made Hitcho Insurance a top choice when it comes to picking an insurance agency. Requesting a consultation is as easy as calling (610) 694-9435.