The four types of Medicare are:

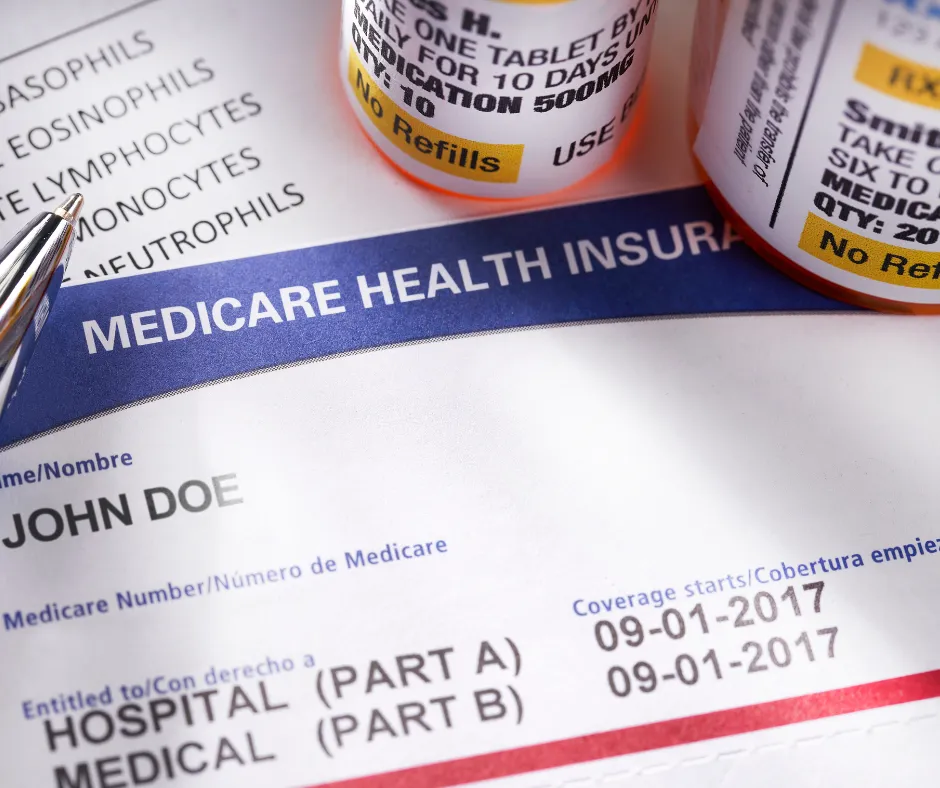

- Part A (Hospital Insurance): Part A covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care.

- Part B (Medical Insurance): Part B covers certain doctors’ services, outpatient care, medical supplies, and preventive services.

- Part C (Medicare Advantage): Medicare Advantage plans are offered by private insurance companies and combine your Part A and Part B benefits (and sometimes cover other services).

- Part D (Prescription Drug Coverage): Part D helps cover the cost of prescription drugs (including many recommended shots or vaccines).

You can enroll in Part A and Part B at age 65, or earlier if you have certain disabilities. You can also enroll in Part C and Part D at any time.

Here is a brief overview of each type of Medicare:

Part A

Part A is premium-free for most people. If you or your spouse worked for at least 40 quarters (10 years) under Social Security, you will automatically qualify for Part A at age 65. If you do not have enough work credits, you may be able to buy into Part A.

Part A covers the following services:

- Inpatient hospital stays

- Skilled nursing facility care (after a hospital stay)

- Hospice care

- Some home health care

Part B

Part B has a monthly premium that is deducted from your Social Security check. You can also choose to pay your Part B premium directly to Medicare.

Part B covers the following services:

- Certain doctors’ services

- Outpatient care (including office visits, lab tests, and X-rays)

- Medical supplies (such as wheelchairs and walkers)

- Preventive services (such as screenings, shots or vaccines, and yearly “Wellness” visits)

Part C

Medicare Advantage plans are offered by private insurance companies. Medicare Advantage plans must cover all of the services that Part A and Part B cover, and many plans also cover additional services, such as dental, vision, and hearing care.

Medicare Advantage plans typically have lower monthly premiums than Original Medicare. They are not designed to pay for all the services in full like a Medicare supplement would.

Part D

Part D is optional, but if you do not have prescription drug coverage through another source, it is a good idea to enroll in Part D. Medicare Part D plans are offered by private insurance companies and vary in price and coverage.

Part D covers the cost of prescription drugs, but you will have to pay a monthly premium and may also have copays and deductibles.

Choosing the right type of Medicare for you

Hitcho Insurance Agency is a trusted Medicare insurance brokerage that can help you enroll in the best type of Medicare Insurance plan based on your individual needs and circumstances. Call Hitcho Insurance today at 610-694-9435 or visit the Hitcho Insurance website at www.hitchoins.com to learn more.